Blog | 04 May 2018

Trump’s tariffs against China are bad news for US farmers, companies and workers!

In drawing up its list of tariffs on $50 billion of Chinese products the Trump administration carefully tried to avoid one of the chief bad effects these tariffs will have on the US population by excluding many consumer goods from the list. This was clear proof the administration feared the hostile reaction from US consumers as prices went up on these imported goods in US shops. But by concentrating on trying to lessen the impact on US consumers the Trump administration has necessarily increased the negative effects on US jobs and particularly US manufacturers and farmers. This has meant it has not really concealed the negative effects on the US economy at all. Therefore, within hours of the US announcement, and even before China’s firm response, even Western commentators were accurately pointing out the main groups within the US itself that would be hit by the tariffs. It is important to understand not only the impact on China of the Trump proposed tariffs but also the impact in the US. It is therefore worth looking at accurate Western studies of this.

David Fickling, writing in Bloomberg, noted the effect of the US tariffs may remove as much as half of the benefit which the Trump administration recently gave to US manufacturing companies via tax cuts. Bloomberg’s headline was clear: ‘Trump Tariffs Stick It to U.S. Manufacturers. Firms might as well give back half of that $26 billion-a-year tax cut they just got.’Fickling entirely accurately analysed the attempted concealment of the impact of the US actions on the US economy and population: ‘the list [of US tariffs] appears to have been chosen with care. Officials started with all products felt to benefit from Chinese industrial policies, before removing those that were “likely to cause disruptions to the U.S. economy,” those that would hit consumers’ pockets hardest, and those that couldn’t have levies for legal or administrative reasons.‘The protection of individuals’ wallets is probably the most important part of that… China has a substantial advantage in this trade war in that the majority of its biggest exports to the U.S. are consumer goods whose purchasers tend to be price-sensitive voters. Trade in the opposite direction focuses far more on intermediate products bought by Chinese companies expected to do their bit for Beijing. By sparing consumers, Lighthizer is sending a strong signal he won’t let this fight be lost because of discontent on the home front.‘That’s why, while hundreds of product lines under tariff code 85 (electrical machinery and equipment and parts thereof) will be subject to a 25 percent impost, subsection 8517 — mobile phones, which constitute about 40 percent of U.S. imports from China for that category — won’t suffer a cent.’But by exempting many consumer goods, while simultaneously aiming to meet the $50 billion target for sectors hit by tariffs the Trump administration had wanted, the US has been forced to affect a much wider range of non-consumer goods. Again, as the Bloomberg article correctly noted, it is a: ‘fact that the plan will most likely hurt the parts of the economy it purports to help. Another way of looking at the $12.5 billion that will be levied is that it’s essentially the government taking back about half of that roughly $26 billion-a-year tax cut it just delivered to manufacturers.

‘Once you consider the ways domestic suppliers could raise prices in response to the reduced competition from China (as is already happening with steel and aluminum), the cost to end-product manufacturers will probably be higher. Producer prices in the sector are already rising at the fastest pace in almost six years; the squeeze to profits should intensify before it eases.

‘The second point is related. The list at present isn’t written in stone — instead it will be put out to industry consultation for 60 days. That gives manufacturers ample time to make their complaints to Washington, and to get their carve-outs in return. The Trump administration isn’t famed for its resistance to such influence: 195 of the executive branch’s 2,684 appointees are former lobbyists, according to a database by journalism nonprofit ProPublica.

‘Such pushback will probably be to the benefit of a U.S. economy that was doing perfectly well before the current skirmish came along. But it will weaken Washington’s hand in the months ahead. The National Association of Manufacturers is already calling for a trade agreement, rather than the current path toward a conflict.’

Fickling’s overall conclusion was entirely accurate: ‘President Donald Trump must now choose whether his main objective is helping American manufacturers, or sticking it to the Chinese. He can’t have both.’

US farmers protest

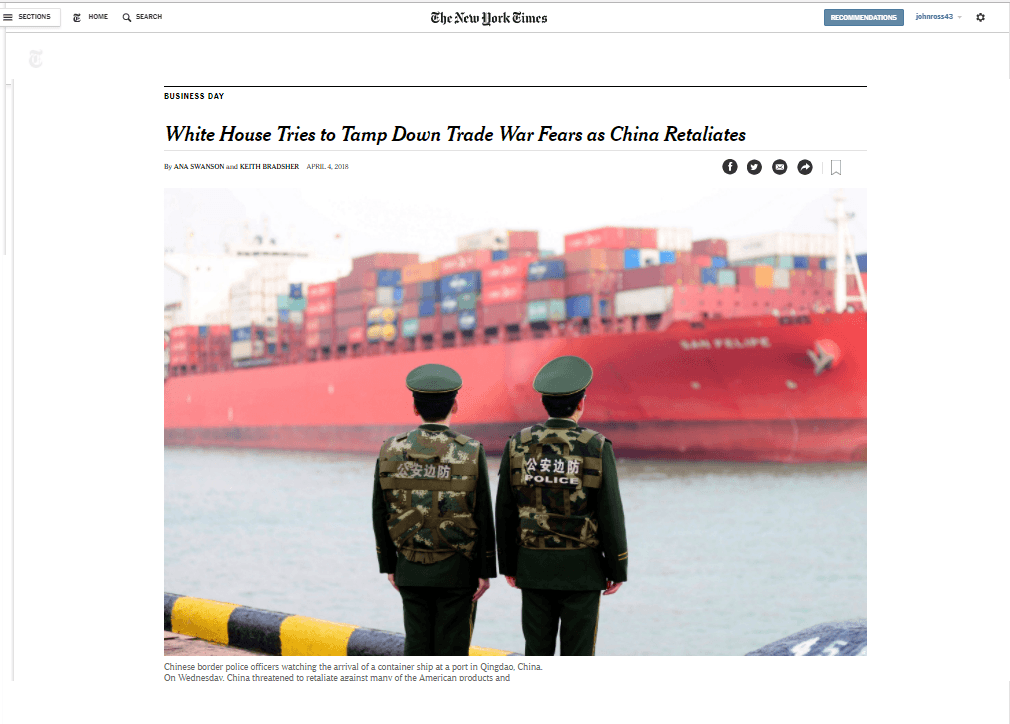

In addition to the impact on US manufacturers the Financial Times particularly noted the effect of the US farm sector and the reactions from it: ‘Max Baucus, a former senator from Montana and US ambassador to China who now serves as the co-chairman of the lobby group Farmers for Free Trade, said farmers were being “squeezed from all sides” by the Trump administration’s attack on China.

‘“First, the tariffs the US announced today will make the [agricultural] equipment and inputs they rely on more expensive. Then they will face new tariffs on their exports when China retaliates,” Mr Baucus said. “American farmers are watching this daily trade escalation closely, and they are worried.”

‘US business groups have called for the Trump administration to rethink its plan for tariffs, arguing that while they shared its concerns about China’s intellectual property regime the White House plan amounted to new taxes on US consumers and businesses… “imposing taxes on products used daily by American consumers and job creators is not the way to achieve those ends,” said Myron Brilliant, the head of international affairs at the US Chamber of Commerce.’

The action China has now announced on US soybeans exports will of course tighten that squeeze on US farmers. The Financial Times noted: ‘John Heisdorffer, president of the American Soybean Association, warned that the Chinese tariff would “have a devastating effect on every soybean farmer in America”. He urged Mr Trump to “engage the Chinese in a constructive manner, not a punitive one”.’

The strategic target of the US tariffs

Bllomberg also analysed that the clear aim of the tariffs was to attempt to block China’s advance into more technologically advanced production. It noted “The tariffs may have only a minor economic impact, increasing levies by $12.5 billion on Chinese shipments to the U.S. that reached $506 billion last year, said Shane Oliver, the head of investment strategy at AMP Capital Investors Ltd. in Sydney. That’s an average tariff increase on overall imports from China of just 2.5 percent, he said.” But: ‘In targeting sectors that Beijing is openly trying to promote, the U.S. is signaling that its strategic aim in the current conflict is preventing China from gaining the global technological leadership that it wants.”’

But in attempting to block China’s rise the Trump administration has launched an attack not only on China but on US companies, workers and farmers. The outcome of the situation will be decided by the interaction of both fronts in this battle.

1 Comments

Leave a Comment

You must be logged in to post a comment.

Very good analysis, thanks.